sales tax in fulton county ga 2019

Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area.

The Fulton County Board of Assessors can be reached at.

. The Fulton County sales tax rate is. Depending on local municipalities the total tax rate can be as high as 9. What is the sales tax rate in Fulton County.

The minimum combined 2022 sales tax rate for Fulton County Georgia is. The Fulton County Sheriffs Office month of November 2019 tax sales. Surplus Real Estate for Sale.

GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below. Cities towns and special districts within Fulton County collect additional local sales taxes with a maximum sales tax rate in Fulton County of 89. This table shows the total sales tax rates for all cities and towns in Fulton County including all local taxes.

This coupled with the base rate of Georgia sales tax means the effective rate is 89. The 1 MOST does not apply to sales of motor vehicles. Actual Salary and Benefits.

Fulton Board of Assessors Suite 1047B 141 Pryor Street SW Atlanta GA 30303. The Georgia GA state sales tax rate is currently 4. The proposed short-term plan update includes 16 B in rapid transit projects across Fulton County based on the passage of HB 930 which allows for a 02-cent sales tax over 30 years 100 M in State funding allocated to GA 400 and an assumed 200 M in Federal.

For TDDTTY or Georgia Relay Access. Georgia sales tax details. The December 2020 total local sales tax rate was also 7000.

Other Taxes Sales Tax. 2020 rates included for use while preparing your income tax deduction. The Georgia state sales tax rate is currently.

Georgia has 961 cities counties and special districts that collect a local sales tax in addition to the Georgia state sales taxClick any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code. Version 1052 Download 131 MB File Size 1 File Count January 30 2019 Create Date March 25 2019 Last Updated. Personal finance personal taxes.

Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. This is the total of state and county sales tax rates.

The Board of Commissioners and County Manager have categorized County efforts into. 060 Fulton Not Atlanta 775 ML E Tf 060A Fulton In Atlanta 89 ML E O mTa 061 Gilmer 7 L E S 062 Glascock 8 L E. 445 802 Views.

I didnt see any data on the SF sales tax revenue. The Georgia state sales tax rate is currently 4. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Due to renovations at the Fulton County Courthouse. Water and Sewer Expenditures July YTD 2019. As required by law the Fulton County Sheriffs office conducts its tax sale on the steps of the Fulton County Courthouse on the first Tuesday of each month beginning at 1000 AM though they occasionally skip a month.

This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49.

The Fulton County sales tax rate is 3. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county.

It usually takes 2-3 hours for them to work through the list which usually includes over 100 properties. Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses. 26 Votes The minimum combined 2020 sales tax rate for Fulton County Georgia is 89.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Fulton Countys sales tax is 775 percent collected on all retail sales except food. The latest sales tax rate for Atlanta GA.

Your assessment may have gone up. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. Fulton County mailed out 2019 tax assessment notices on June 18 and by now you likely have reviewed the numbers.

The 2018 United States Supreme Court decision in South Dakota v. The county-level sales tax rate in Fulton County is 3 and all sales in Fulton County are also subject to the 4 Georgia sales tax. 404-612-6440 or by mail at.

FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis. This presentation outlines an update to Fulton Countys Transit Master Plan. However even if you have seen an increase in your property value changes approved by voters last November may protect you from huge jumps in your actual tax bill and potentially can reduce your.

Helpful Links Cities of Fulton County. If you need access to a database of all Georgia local sales tax rates visit the sales tax data page. The current total local sales tax rate in Floyd County GA is 7000.

What is the sales tax on food in Fulton County GA.

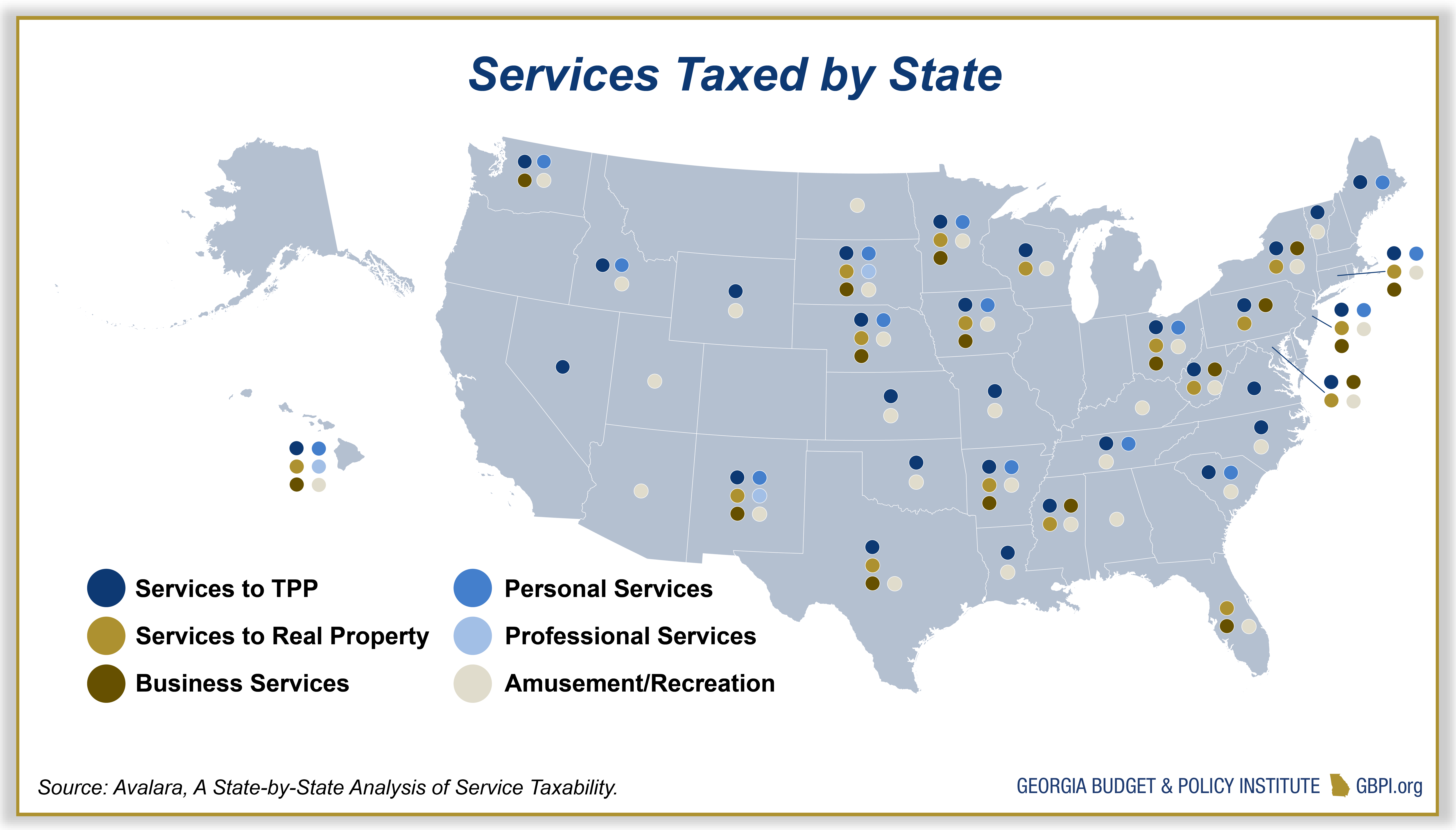

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

How Many Small Businesses Are There In Georgia See The Past 5 Years Of Stats

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

2019 2022 Form Ga Application For Basic Homestead Exemption Fulton County Fill Online Printable Fillable Blank Pdffiller

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tsplost And Marta Referenda Atlanta Ga

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ga Application For Basic Homestead Exemption Fulton County 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Frequently Asked Questions Faq Atlanta Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

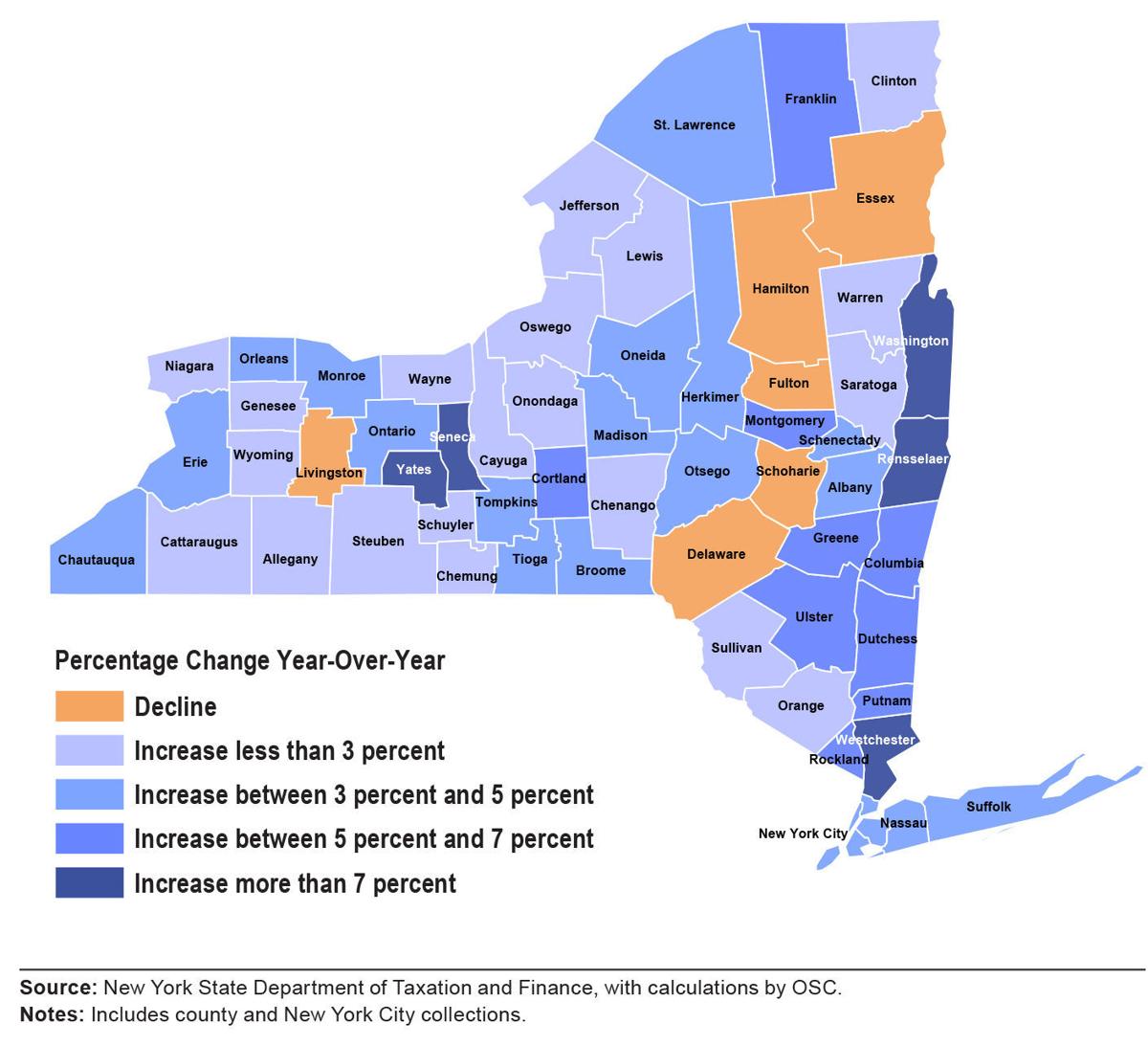

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute